SHERLOCK HOLMES - TAKING STOCK

Author: Liese Sherwood-Fabre, award-winning writer

Stock brokerage firms are mentioned in two different cases in the Canon. In addition to “The Adventure of the Stockbroker’s Clerk,” James Dodd in “The Adventure of the Blanched Soldier” worked as a stockbroker on Throgmorton Street. While stockbroking has existed for almost a thousand years, such firms did not become prominent in England until the 1800s.

The role of the English stockbroker and the place where they operated—the “exchange”—evolved over time. The first organized system began in France in the eleventh century as a means of regulating the buying and selling of agricultural debt. In the 1300s, commodity traders set up houses in major cities such as Amsterdam. (1) Traditionally, companies were owned by individuals or a small group. As business ventures grew larger, however, they proved to be riskier as well as requiring greater funds. Discovery voyages, overseas trading, and financing foreign military campaigns offered stock to a large number of investors who then left its management in the hands of the small group who originated the venture. The Dutch East India Company became the first such publicly traded company in 1602. (2)

In England, joint stock companies were formed in the 1500s, but the sale of shares in such enterprises was limited and did not require a stockbroker. In the late 1600s, changes in banking regulations increased the number of joint stock companies tenfold in only six years, and the first stockbrokers—who bought and sold shares as an adjunct to another profession—appeared at that time. Business was first conducted at the Royal Exchange, where other merchants also conducted business, but as the number of stockbrokers grew and displayed a rowdy behavior not acceptable to others in the marketplace, the government sought to regulate them. Rather than accept such interference, these men left to set up shop in the coffeehouses between Cornhill and Lombard streets—with one of the most prominent being Jonathan’s Coffeehouse on Exchange Alley. (3)

While most brokers in these exchanges were reputable, some followed less-than-acceptable practices. To have greater control over who they allowed into the exchange, some brokers left Jonathan’s and set up a new exchange—called “New Jonathan’s” or “The Stock Exchange.” Transactions were still not regulated and any broker who could pay the daily entry fee could conduct business. (4) Two specialists arose during this time—brokers and jobbers. Brokers represented clients or investors who desired to buy or sell a particular security within a certain price range. The broker’s counterpart, the jobber, offered to buy or sell the desired security to the broker (but never directly to an investor). The broker worked on a commission charged to the client while the jobber made his on the “spread” between the bid and asked-for price (the notion of “buy low, sell high”). (5)

A tension developed between the owners of the new coffeehouse and the brokers. Those running the coffeehouse preferred allowing in more patrons because of the fee charged, while the brokers were concerned about still dealing with their less reputable colleagues. In 1801, the brokers left again for a new establishment governed by written regulations for conducting business and the modern London Stock Exchange (LSE) was created. (6)

While the LSE was the United Kingdom’s most important, the Industrial Revolution brought about a number of new companies as well as infrastructure projects that required large capital investments, prompting the creation of about twenty stock exchanges throughout the UK. (7)

New technologies were added to link both the English and international exchanges. In 1840, the telegraph provided trade information from the New York exchange in only 20 minutes (vs. sixteen days by mail). The ticker tape replaced the telegraph in 1872, and the telephone replaced it in 1880. (8)

“The Adventure of the Stockbroker’s Clerk” provided an example of the variety of investments available. Beddington stole both American railway bonds as well as mining and other company scrip from the firm Mawson and Williams. Bonds are legal evidence of the provision of long-term debt (the holder to receive reimbursement plus interest when the loan was repaid). Scrip, on the other hand, indicated ownership of a portion (share) of a company. (9) As this theft indicated, stockbroker dealings could involve hundreds of thousands of pounds, but risk was also involved. Hall Pycroft lost his position with Coxon and Woodhouse when they folded after a bad investment. Thanks to a quick-thinking police officer and Holmes’ assistance to the stockbroker’s clerk in apprehending the culprits in this case, however, Mawson and Williams failed to suffer similar losses and disgrace.

Liese Sherwood-Fabre will be attending Bouchercon 2021 in New Orleans August 25-29. She will be appearing on a panel discussing “Suspense, Action, and Conflict” on Friday at 11 and participating in the small press/indie author book signing where she will have copies of her “Early Case Files of Sherlock Holmes” series available. She invites you to join her in letting the good times roll.

More information about Liese Sherwood-Fabre:

Resources:

1) https://www.theclassroom.com/the-history-of-stock-brokerage-firms-13635698.html

2) https://www.encyclopedia.com/books/politics-and-business-magazines/london-stock-exchange-limited

3) Edward Stringham, “The Emergence of the London Stock Exchange as a Self-Policing Club,”

Journal of Private Enterprise, January, 2002.

4) https://www.londonstockexchange.com/discover/lseg/our-history

5) https://hsc.co.in/difference-between-jobber-and-broker/

6) Ranald Michie, The London Stock Exchange: A History. Oxford: Oxford University Press, 1999.

7) https://www.encyclopedia.com/books/politics-and-business-magazines/london-stock-exchange-limited

8) https://www.londonstockexchange.com/discover/lseg/our-history

9) https://wikidiff.com/bond/scrip

Thank you very much for this article Liese Sherwood-Fabre.

Recommended article:

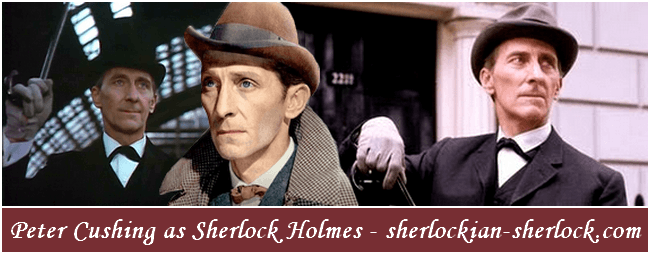

The British actor who was a Sherlock Holmes fan:

Peter Cushing as Sherlock Holmes

|